pay indiana unemployment tax online

P O Box 55097. Please use the following steps in paying your unemployment taxes.

Property Management Company Renturhome Property Valuation Property Management Real Estate

This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems.

. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Generally if you apply online. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient.

Use Form 940 to report your annual FUTA tax. Write your Social Security number on the. Department of Labors Contacts for State UI.

Find Indiana tax forms. Registering for an Indiana State Unemployment Tax Account. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one.

Ad File your unemployment tax return free. Pay the amount due on or before the installment due date. Search for your property.

124 Main rather than 124 Main Street. Online Payment Service by VPS. Indiana University professor Greg Geisler says the federal government has exempted a portion of the unemployment benefits from federal income taxes.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the. Electronic Payment debit block information. You can find more details about employment tax due dates here.

Indiana New Hire Reporting. Register online with the Indiana Department of Revenue on INBiz. Know when I will receive my tax refund.

You also can file a wage report online or adjust a filed wage report online. Tax Liabilities and Case Payments. You will receive your Tax ID within a few hours of completing the online registration.

To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by. You can apply for an EIN at IRSgov.

To establish your Indiana UI tax account youll need a federal employer identification number EIN. For best search results enter a partial street name and partial owner name ie. Search by address Search by parcel number.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. You can pay taxes online using the EFTPS payment system. Unemployment Tax Payment Process.

Business entities that have paid wages in Indiana and met employer qualifications are required to register with the Indiana. 100 free federal filing for everyone. For a list of state unemployment tax agencies visit the US.

INDIANAPOLIS With over 12 million unemployment claims in 2020 more Hoosiers than ever will be including unemployment income for the first time when filing their. Enclose your check or money order made payable to the Indiana Department of Revenue. Most employers pay both a Federal and a state unemployment tax.

Indiana new hire online reporting. In Indiana these funds come from a tax that employers must paycalled unemployment taxesthat are collected by the state and paid out to workers who have lost. Indiana New Hire Center.

It Has The Professionals To Provide The Services At Cheap Rate And Fast To Meet The Deadline Of The Payment Of Taxes Tax Attorney Tax Lawyer Tax Refund

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

Tax Forms For Unemployment Benefits Going Out Soon Here S How To Request A Correction Klas

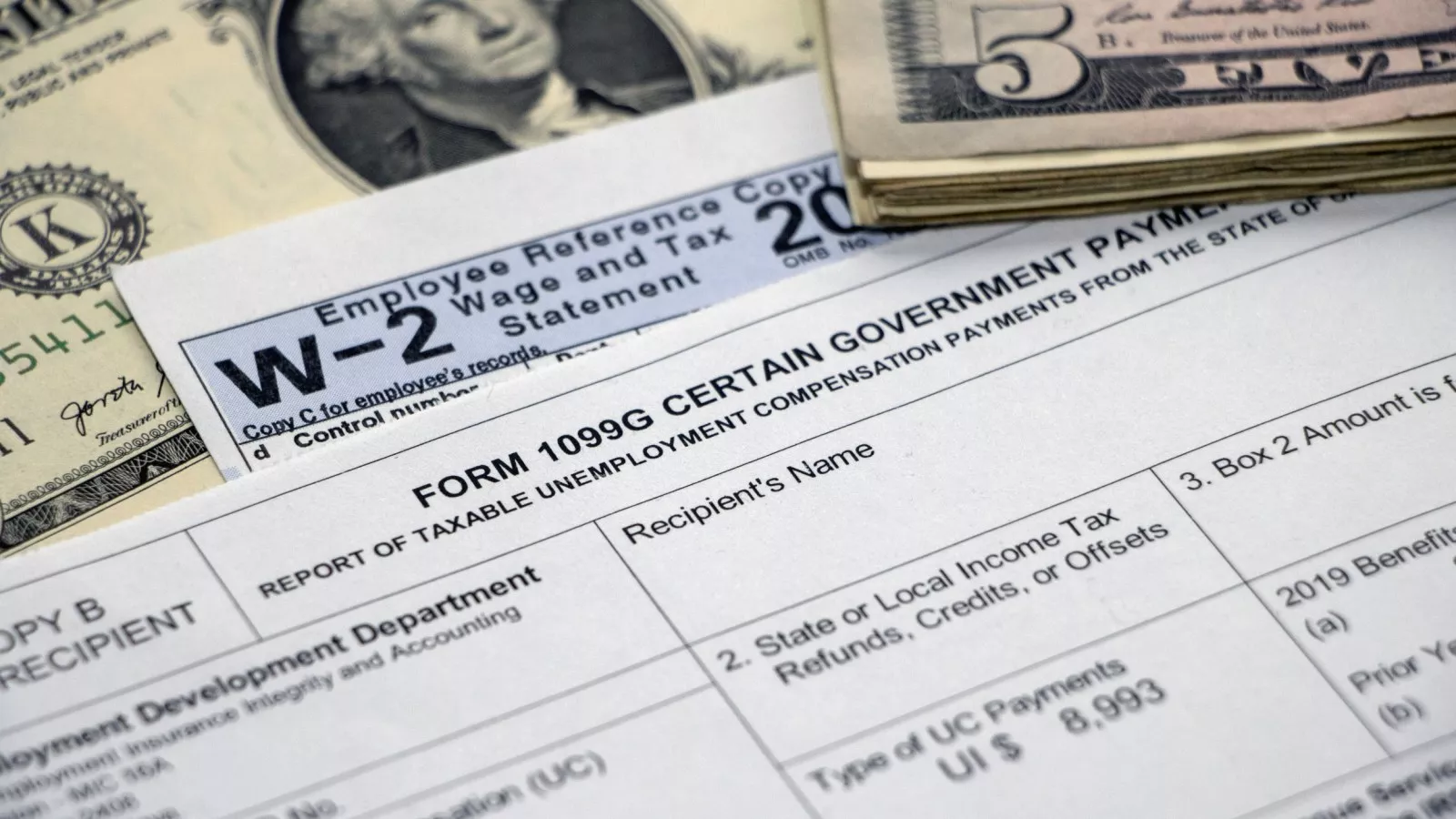

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Enjoy Casino Games Enjoy The Thrill And Excitement Of Winning Br Farm N Trade Is The Game For You Farm N Tr Make Real Money Trading Stock Options Trading

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Indiana Form Uc 1 Updates Tax Alert Paylocity

2022 Federal Payroll Tax Rates Abacus Payroll

Survey What Kind Of Sharer Are You Via Karin Sebelin Life Insurance For Seniors Life Insurance Policy Prayers

Dwd Will Collect Unemployment Overpayments From Tax Refunds

How To File Your Quarterly Wage Report And Unemployment Tax Return Kansas Department Of Labor Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Special Needs Trust 7 Frequently Asked Questions About Special Needs Trusts Tax Tax Consulting Tax Business Tax

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Dor Important Tax Information About Your Unemployment Benefits

Secure Login Access Http Www Netankiety Pl The University Alliance Login Here Secure User Login To Univers Places To Visit I Am Awesome Interesting Reads

How To File Your Quarterly Wage Report And Unemployment Tax Return Kansas Department Of Labor Youtube